Recent events have caused a stir in the world of cryptocurrency, as reports emerged of the US government transferring 3,940 Bitcoins (BTC) to Coinbase Prime. With a value of approximately $240 million, this transfer has raised concerns about the stability of Bitcoin’s price and its impact on investor sentiment.

The Transfer and Its Importance

One quiet Tuesday morning, experts in blockchain technology noticed a substantial movement in the Bitcoin blockchain. A wallet linked to the US government executed a transfer of 3,940 BTC to a Coinbase Prime address. While not unheard of, this event immediately grabbed the attention of cryptocurrency analysts and enthusiasts.

Origin of the Seized Bitcoin

These Bitcoins were initially seized by US authorities during the trial of Banmeet Singh, a prominent figure in the Silk Road dark web marketplace. The Silk Road saga has been a long-standing story in the cryptocurrency community, featuring the US government’s persistent efforts to liquidate assets associated with illegal activities on the platform.

Market Response and Price Volatility

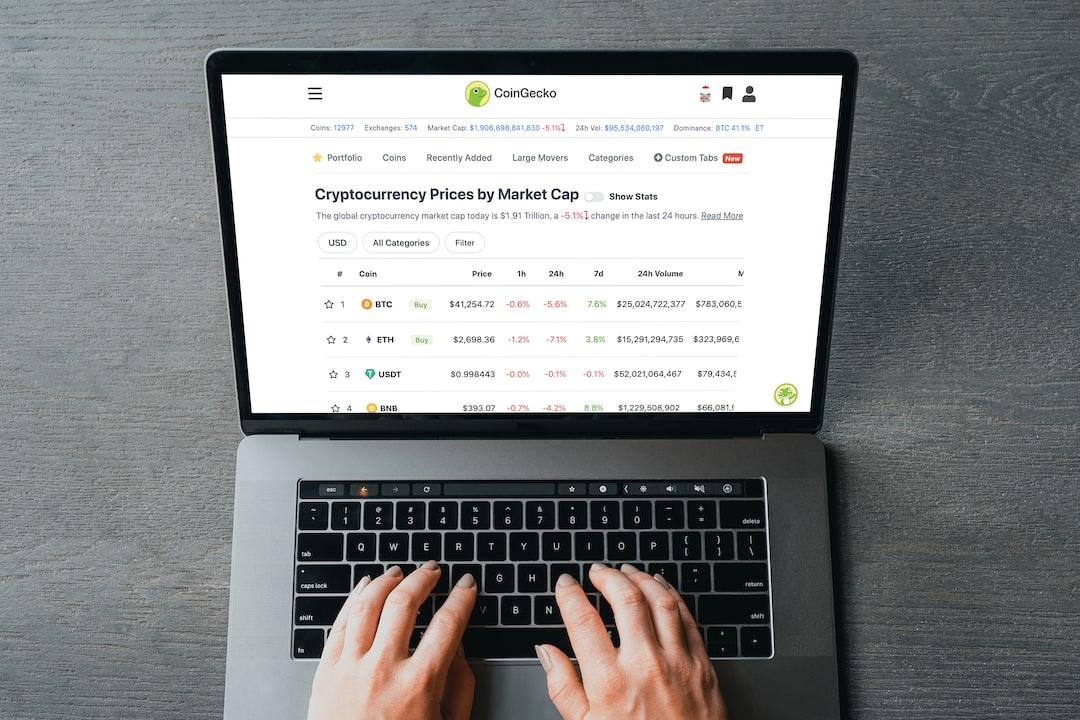

Following the transfer, Bitcoin’s price experienced significant volatility. Market data showed a sharp but brief decline as news of the transfer spread, reflecting heightened uncertainty among traders and institutional investors. This reaction highlights the sensitivity of cryptocurrency markets to large-scale transactions involving major stakeholders like governmental bodies.

Government’s Involvement in Bitcoin Holdings

The US government’s role in Bitcoin goes beyond regulatory oversight. It has become a significant holder of seized cryptocurrencies, using its authority to manage and, at times, liquidate these digital assets. Previous auctions of seized Bitcoins, including those from the Silk Road case, have influenced market dynamics and contributed to ongoing discussions about the role of governments in the cryptocurrency ecosystem.

Investor Sentiment and Market Perception

The transfer has sparked debates among investors about the broader implications for Bitcoin’s market sentiment. Some see it as a precursor to a potential selloff, anticipating increased selling pressure in the short term. Others view it as a strategic move by the government to rebalance its cryptocurrency holdings amid evolving regulatory frameworks and geopolitical tensions.

Regulatory Landscape and Market Stability

The regulatory landscape surrounding cryptocurrencies is continuously evolving globally. Governments are dealing with issues such as consumer protection, financial stability, taxation, and anti-money laundering measures. The US government’s approach to managing seized cryptocurrencies serves as a microcosm of these broader regulatory challenges, highlighting the delicate balance between innovation and regulatory oversight in the digital finance sector.

Future Outlook and Investor Strategy

Looking ahead, investors are advised to maintain a cautious yet informed approach to navigate Bitcoin’s price fluctuations and regulatory developments. The outcome of the government’s recent transfer to Coinbase Prime will likely influence market sentiment in the short term, shaping investor strategies and regulatory discourse surrounding digital assets.

Conclusion: Impact on Bitcoin’s Journey

As Bitcoin continues to navigate its path as a groundbreaking digital currency, its interactions with institutional stakeholders like the US government emphasize the complexities inherent in the cryptocurrency market. While innovations in blockchain technology promise transformative changes in finance and beyond, the convergence of regulatory scrutiny and market dynamics remains a critical factor in Bitcoin’s evolution.

In summary, the US government’s transfer of Bitcoin to Coinbase Prime marks a significant chapter in the ongoing narrative of cryptocurrencies and regulatory oversight. As stakeholders across the globe monitor these developments, the resilience of Bitcoin as a decentralized digital asset will continue to be tested amidst evolving global economic landscapes.